In the fast-paced world of trading, where fortunes can be made or lost in the blink of an eye, the allure of mastering the markets is undeniable. Yet, for novices and seasoned traders alike, the journey towards proficiency is fraught with challenges.

This raises an essential question: should you incorporate a trading simulator into your strategy? These digital platforms allow users to practice trading without the financial risk, offering an enticing glimpse into the complexities of market dynamics. However, while trading simulators boast numerous benefits, they also harbor limitations that can skew ones perception of real-world trading.

As we delve into the advantages and pitfalls of these tools, well navigate through the intricacies of simulated trading to help you determine if they are the right fit for your financial education and market ventures.

Benefits of Using a Trading Simulator

Utilizing a trading simulator can unlock a plethora of advantages for both novice and seasoned traders alike. Firstly, it offers a risk-free environment where individuals can experiment with various strategies without the fear of losing real capital.

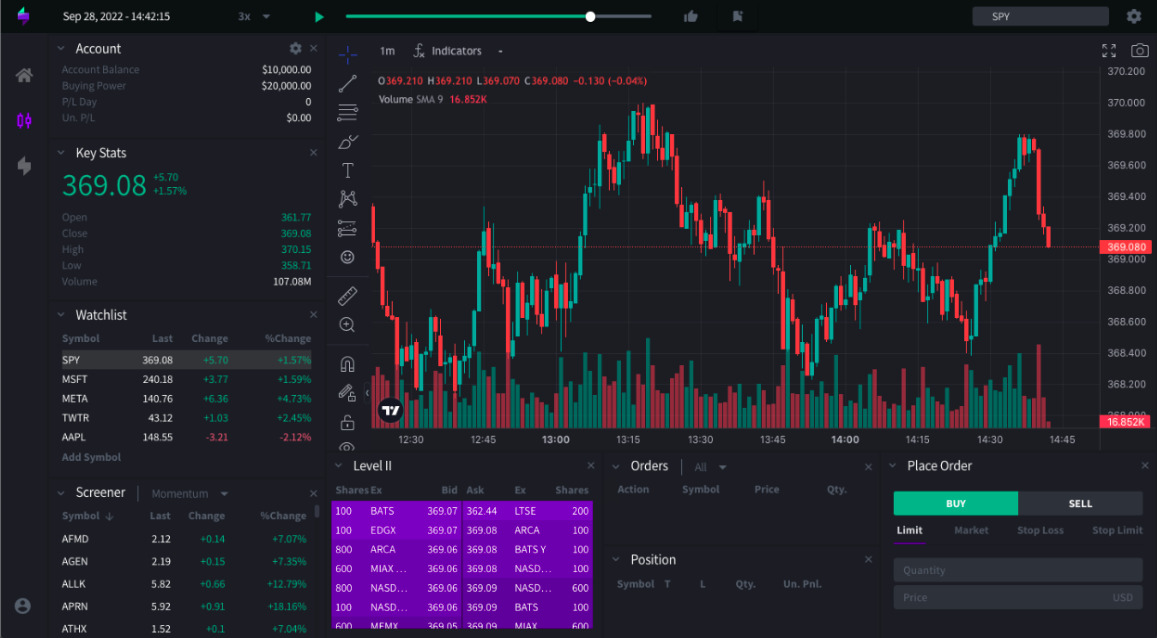

This safe space for trial and error fosters a deeper understanding of market dynamics, enabling traders to refine their skills and build confidence. Moreover, simulators often provide a realistic market atmosphere, complete with live data and diverse asset options, allowing users to practice their decision-making processes under conditions that closely mimic actual trading.

Additionally, many simulators include features like a replay chart free tool, which allows traders to review their trades and analyze market conditions retrospectively, enhancing their learning curve. Beyond skill honing, these tools can help traders identify their psychological triggers by monitoring their reactions in simulated scenarios, shedding light on emotional responses that could hinder performance when stakes are high.

All in all, the benefits of a trading simulator are not merely confined to practice; they extend to education and empowerment, effectively shaping a more adept trading mindset for future endeavors.

Understanding the Impact of Real Money on Decision-Making

Understanding the impact of real money on decision-making reveals a crucial aspect of trading that simulators can only partially emulate. When individuals trade with actual funds, the stakes transform; emotions surge, and cognitive biases come to the forefront.

Consider how the thrill of a sudden market shift might prompt a hasty decision, or how the fear of loss can paralyze even the most calculated traders. In a simulated environment, the absence of real financial consequences can lead to overly confident strategies or reckless experimentation.

Consequently, while simulators provide invaluable practice and analytical skills, they often lack the tension and urgency that accompany tangible investment. This dichotomy raises an essential question: Is the risk of real money a necessary element that shapes a traders intuition and judgment, fostering skills that a simulator simply cannot replicate?

Overconfidence and Risk Mismanagement in a Virtual Setting

In the realm of virtual trading, overconfidence can be a silent yet potent adversary, often leading traders to underestimate risks. When users engage with trading simulators, the false sense of security created by a risk-free environment might encourage them to experiment recklessly, believing they possess superior trading acumen.

This delusion can skew their perception of real-world market dynamics, where the stakes are considerably higher and the consequences of poor decisions are far more severe. It’s not uncommon for traders to exit a simulation feeling invincible, only to face starkly different realities when confronted with real financial stakes.

Moreover, as they hyper-focus on past victories within the simulator, they might neglect the potential for unforeseen variables and market volatility that could easily derail their strategies. Thus, while trading simulators are invaluable for skill development, they can inadvertently foster a mindset that welcomes risk rather than respects it, ultimately leading to mismanagement when traders transition to the actual market.

Conclusion

In conclusion, utilizing a trading simulator can be a valuable tool for both novice and experienced traders, offering a risk-free environment to test strategies and develop skills. While the benefits—such as building confidence, refining techniques, and providing insights into market behavior—are substantial, it is essential to remain mindful of the limitations, such as potential detachment from real trading emotions and market conditions.

By integrating tools like the replay chart free tool into your practice, traders can enhance their learning experience and gain a deeper understanding of market dynamics. Ultimately, the decision to employ a trading simulator should align with individual goals and learning styles, ensuring that every trader can position themselves for greater success in live markets.